Pearl Carbon — Our core innovation, transforming waste into premium, high-performance material.

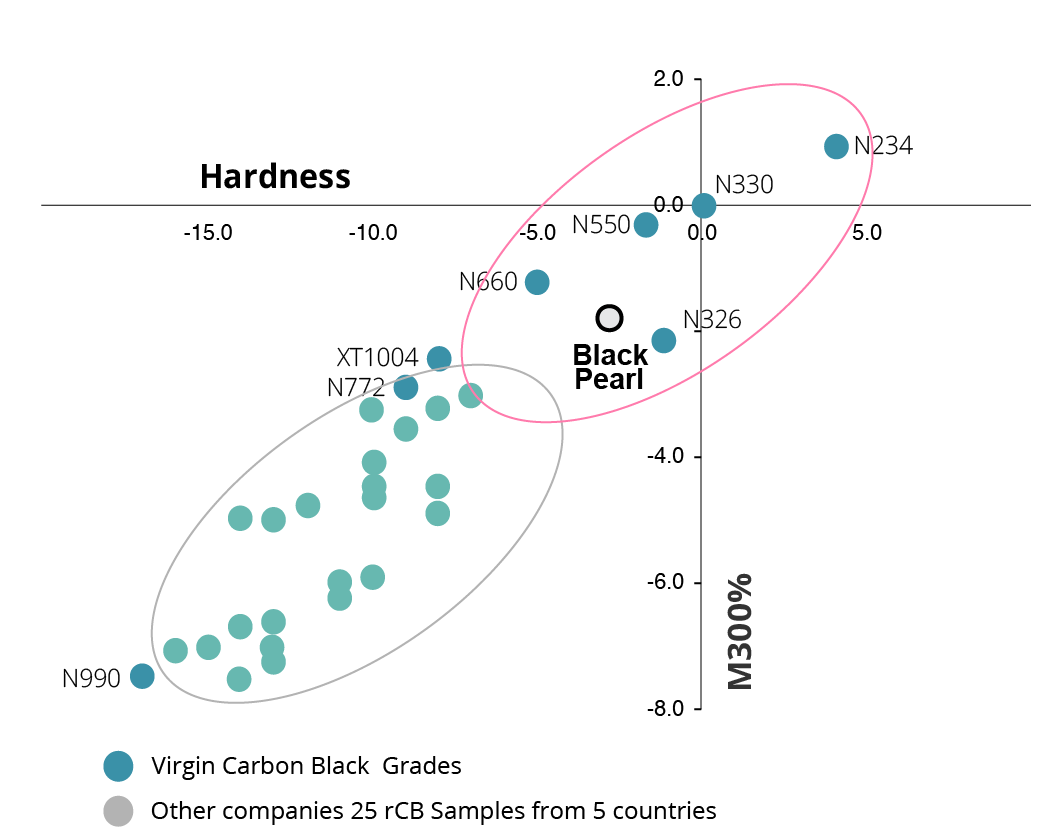

Produced from end-of-life tires, Pearl Carbon is a next-generation recovered carbon black (rCB) engineered to match the performance of leading virgin grades. Its consistent quality and reinforcing properties make it suitable for use in tire, rubber, and industrial compounds offering manufacturers a sustainable, high-value alternative without compromising performance.

In today's carbon black market, rCB represents less than 3% of total supply due to inconsistent production standards and low quality results.

Manufacturers face strict climate targets and CO2 reduction mandates, pushing them toward higher rCB adoption, but a reliable, high-quality supply is scarce.

Only next-generation rCB, such as PearlCarbon, which enables 35–50%+ substitution, can realistically unlock this implementation gap to be used in high-value applications.

Current technology is limited to 10–20% substitution in most applications. A higher-grade, scalable option, like Pearl Carbon, can be implemented globally.

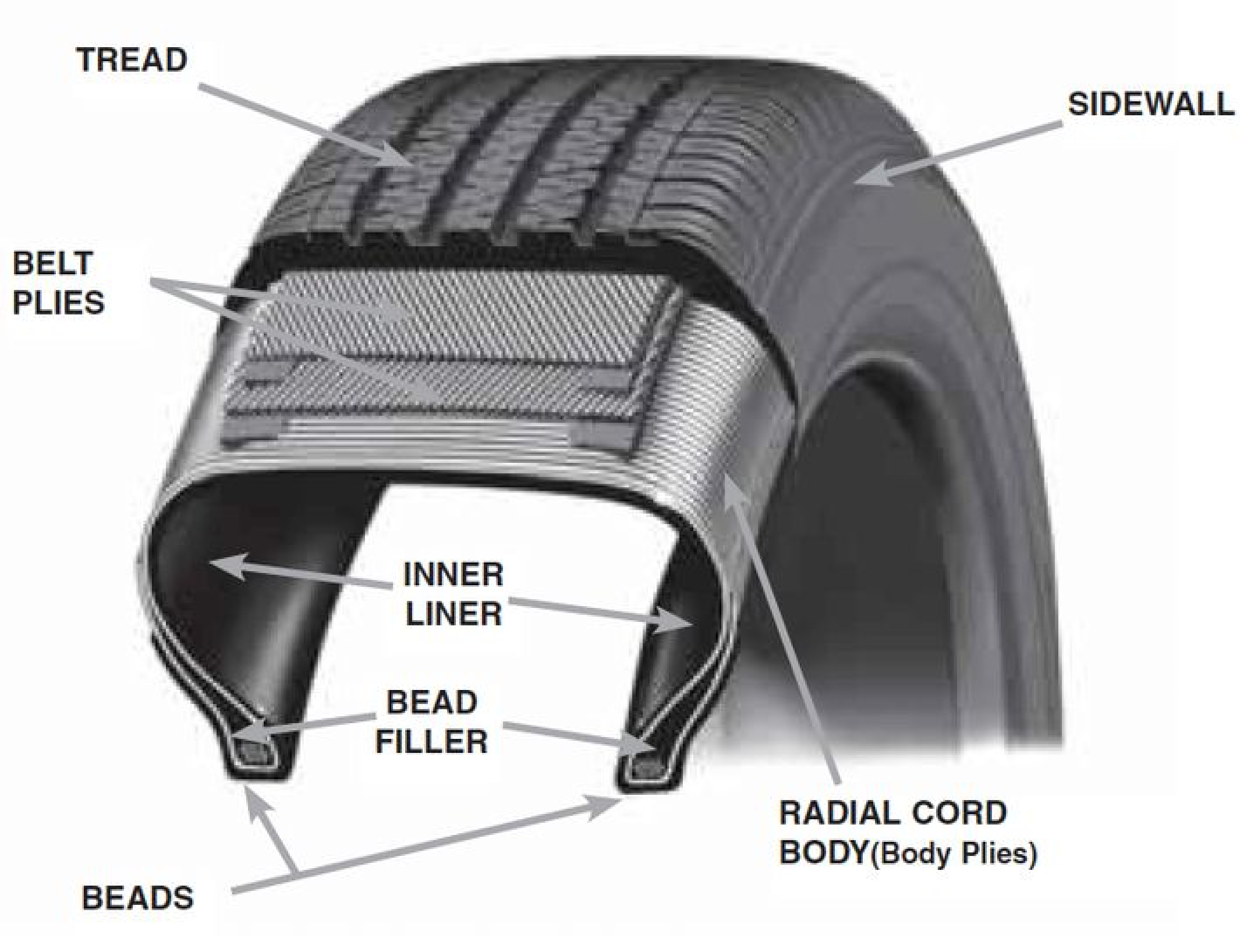

These zones need high stiffness and heat resistance. Pearl Carbon can be used to partially replace vCB in bead filler compounds, while keeping structural integrity and thermal stability.

The liner demands low air permeability. With optimized formulation, Pearl Carbon can be used in blends to maintain optimal air sealing properties.

These layers need high tensile strength and dynamic durability. Pearl Carbon provides adequate reinforcement and heat stability.

Pearl Carbon’s fine particle size and optimized structure creates weathering, cut, and ozone resistance similar to N550–N660 grade sidewalls.

In tests, Pearl Carbon maintains traction, abrasion resistance, and rolling efficiency comparable to premium N660 blacks.

Pearl Carbon can fully replace N660 and more than half of N550 carbon black in tire carcass, sidewall, and sealing layers delivering matching hardness and balanced mechanical performance. These two grades represent over 30% of global carbon black use, making this substitution highly impactful for the tire industry.

Also, since it loses less energy when the tire deforms, Pearl Carbon can be used in under-tread layers of industrial tires, similar to N326, meeting ASTM D8178 standards.

Pearl oil — Renewable fuel from waste That Delivers cleaner heat, power, and Manufacturing.

Extracted through advanced pyrolysis, Pearl Oil is a renewable, energy-rich liquid fuel derived from waste tires. It serves as a cleaner substitute for conventional fossil fuels in heat, power, and industrial processes by reducing emissions, cutting energy costs, and contributing to a more sustainable energy economy.

PEARL STEEL — Turning tire wire into high value steel feedstock.

Recovered from end-of-life tires, Pearl Steel is a high-density, impurity-free steel scrap that meets the quality standards of foundries and mills. Through advanced magnetic separation and cleaning technology, we turn a byproduct once considered waste into a valuable raw material for new steel production — reducing resource consumption and supporting a circular economy.